Limn is free. But it is also for sale! All issues of Limn are available open access to read online as well as available in a beautifully designed magazine, avaliable for sale. You can also access a PDF version of the magazine, for which we ask a small donation, if you can afford to give one.

All Issues

-

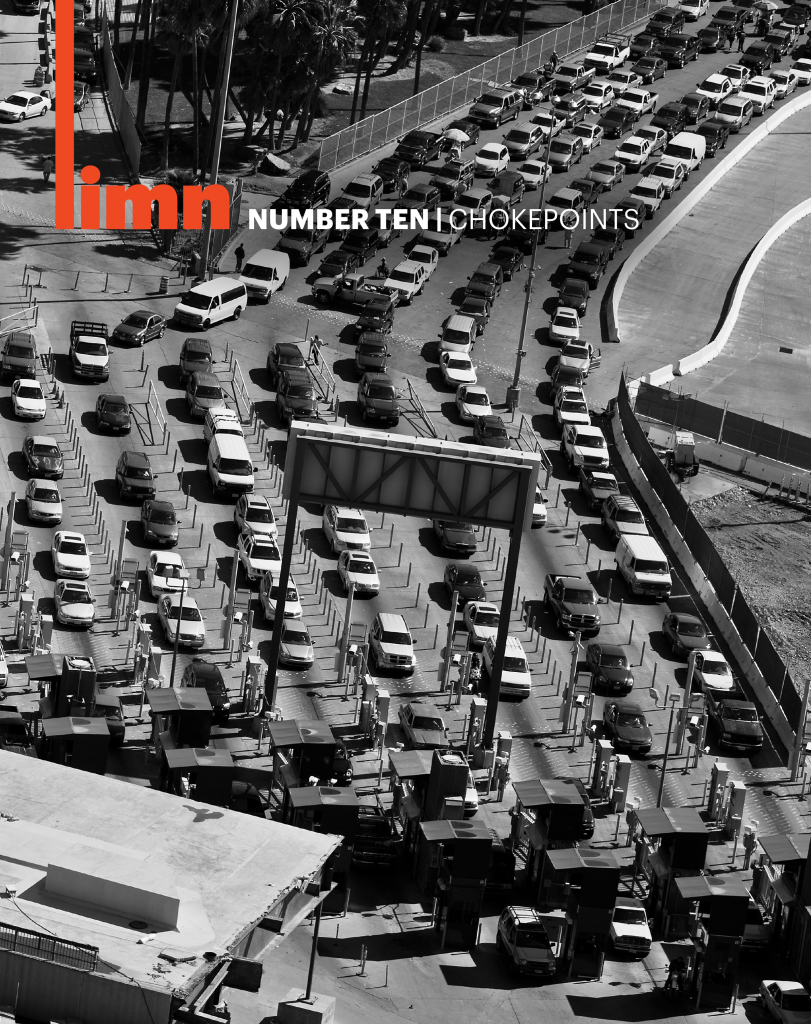

Issue no. 10: Chokepoints

Limn 10 explores chokepoints, sites that constrict—or choke—the flows upon which contemporary life depends. Malfunction brings widespread effects. At once vital yet vulnerable, why do chokepoints work? What happens when they do not?

-

Issue no. 9: Little Development Devices / Humanitarian Goods

In this issue of Limn we examine the recent profusion of micro-technologies in the worlds of humanitarianism and development, some focused on fostering forms of social improvement, others claiming to alleviate suffering, and many seeking to accomplish both.

-

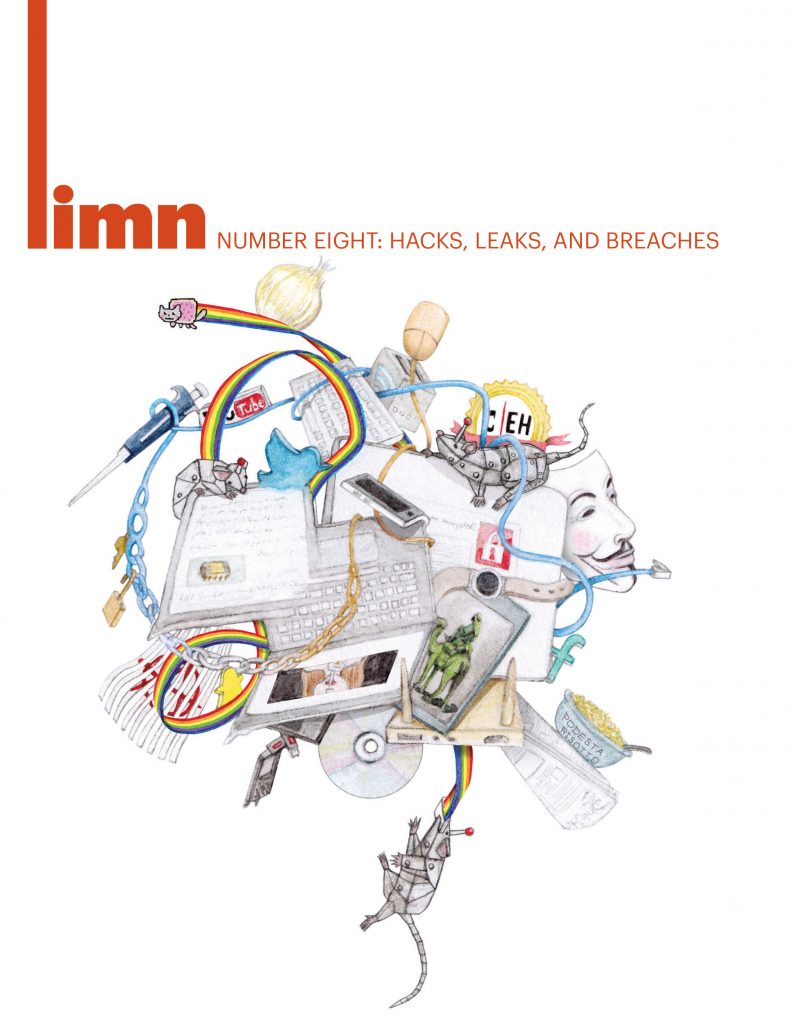

Issue no. 8: Hacks, Leaks, and Breaches

From the surveillance of dissidents to the hacking of elections to the weaponization of memes, hacking is changing in character, and it is changing the world. Have hacking and hacks crossed a techno-political threshold? How has the relationship of hacking and hackers to their own collectives, to governments, and to the tools and techniques been transformed recently? What does it mean to be a hacker these days, and how does it differ from engineering, from “cyber-security,” from information warfare or from hacktivism?

-

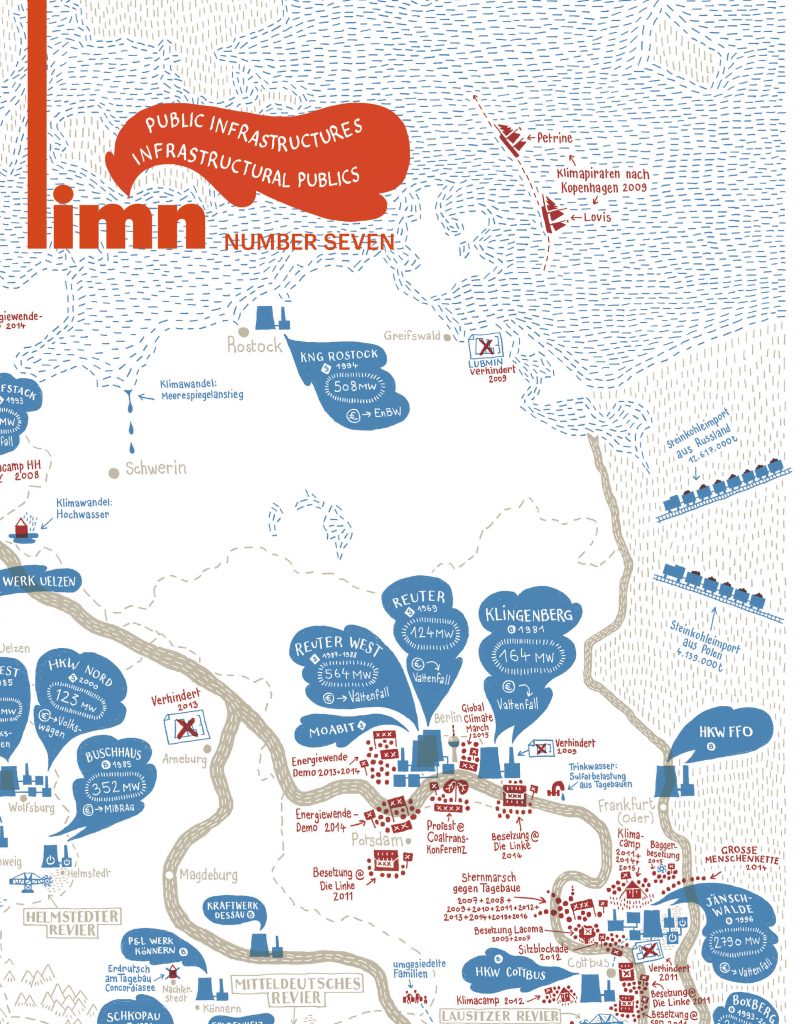

Issue no. 7: Public Infrastructures/Infrastructural Publics

This issue of Limn explores new formations of infrastructure, publicness, and expertise.The contributions examine how new forms of expertise conceive the public and make claims in its name, how publics are making novel claims on experts (and claims to expertise), and how earlier norms and techniques of infrastructure provisioning are being adapted in the process.

-

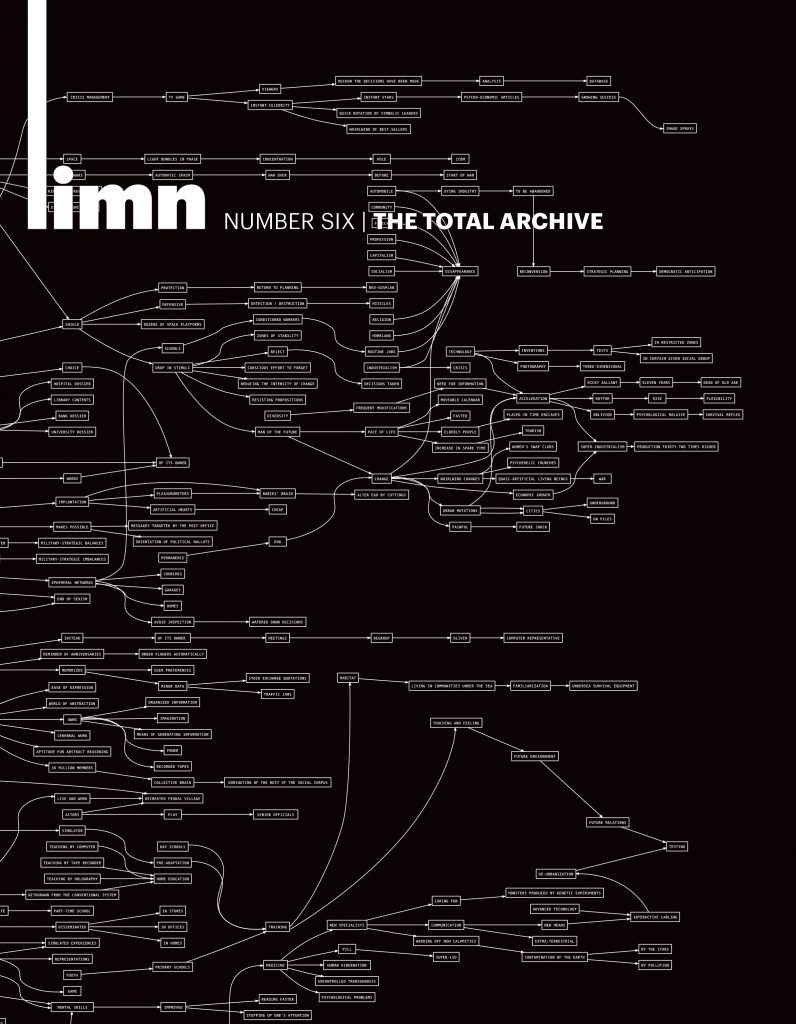

Issue no. 6: The Total Archive

Vast accumulations saturate our world: phone calls and emails stored by security agencies; every preference of every individual collected by advertisers; ID numbers, and maybe an iris scan, for every Indian; hundreds of thousands of whole genome sequences; seed banks of all existing plants, and of course, books… all of them. Just what is the purpose of these optimistically total archives, and how are they changing us?

-

Issue no. 5: Ebola’s Ecologies

This issue of Limn on “Ebola’s Ecologies” examines how the 2014 Ebola outbreak has put the norms, practices, and institutional logics of global health into question, and examines the new assemblages that are being forged in its wake.

-

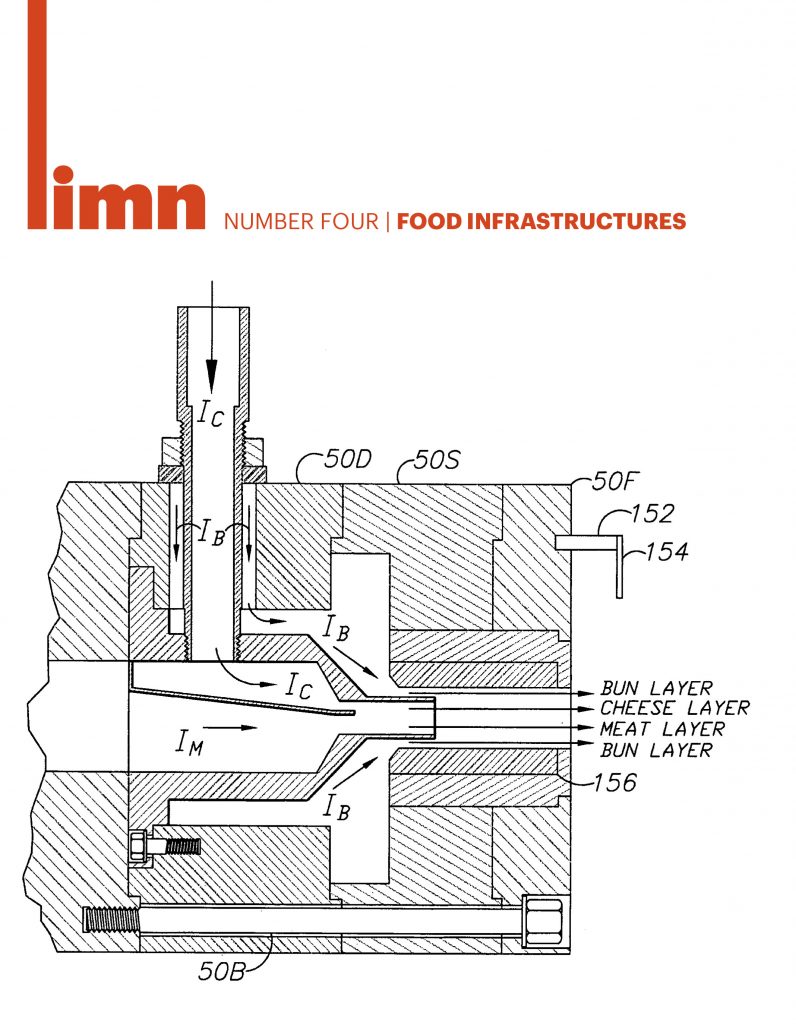

Issue no. 4: Food Infrastructures

This issue of Limn analyzes food infrastructures and addresses scale in food production, provision, and consumption. We go beyond the tendency towards simple producer “push” or consumer “pull” accounts of the food system, focusing instead on the work that connects producers to consumers. By describing and analyzing food infrastructures, our contributors examine the reciprocal relationships among consumer choice, personal use, and the socio-material arrangements that enable, channel, and constrain our everyday food options.

-

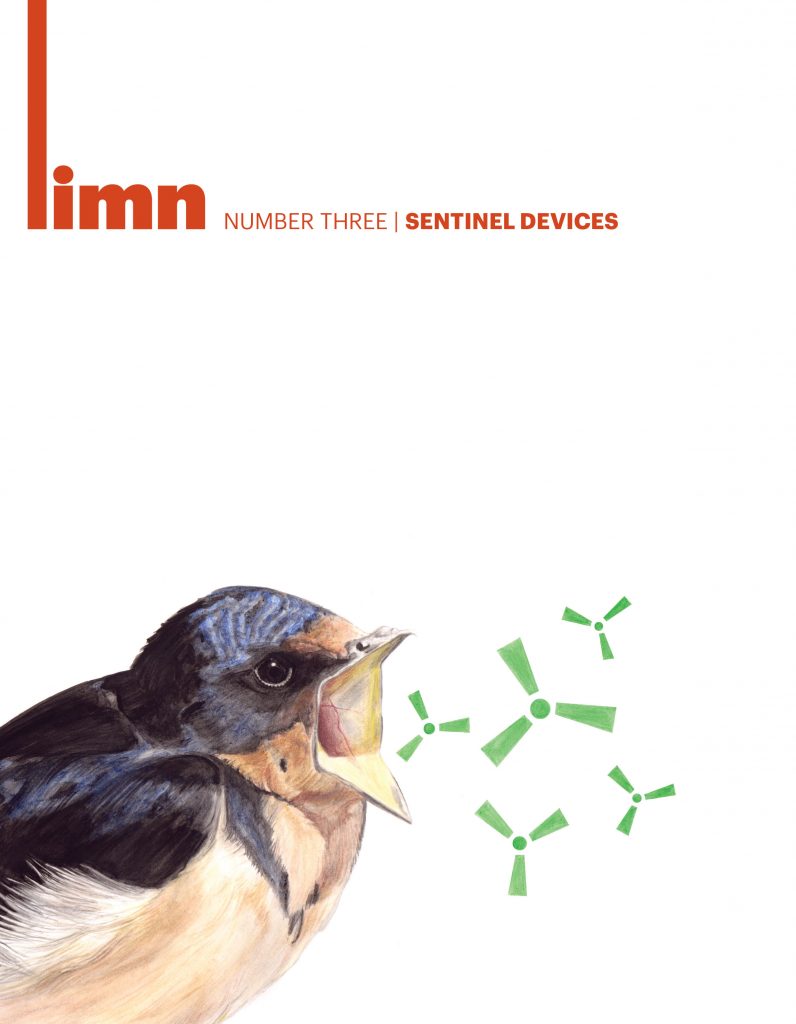

Issue no. 3: Sentinel Devices

The polar ice cap rapidly recedes; colonies of honeybees collapse in alarming numbers; androgynous fish are detected in rivers and streams. These reports not only describe recent events, but also function as signs of an ominous and rapidly encroaching future. In this issue of <em>Limn</em> we focus on how this future makes its appearance in the present. Many of the threats we now find most alarming-climate change, environmental radiation, emerging disease, endocrine disrupters, toxic chemicals-are not immediately perceptible to human senses. We rely on non-human indicators, whether animals or detection devices, to alert us to their possible onset.

-

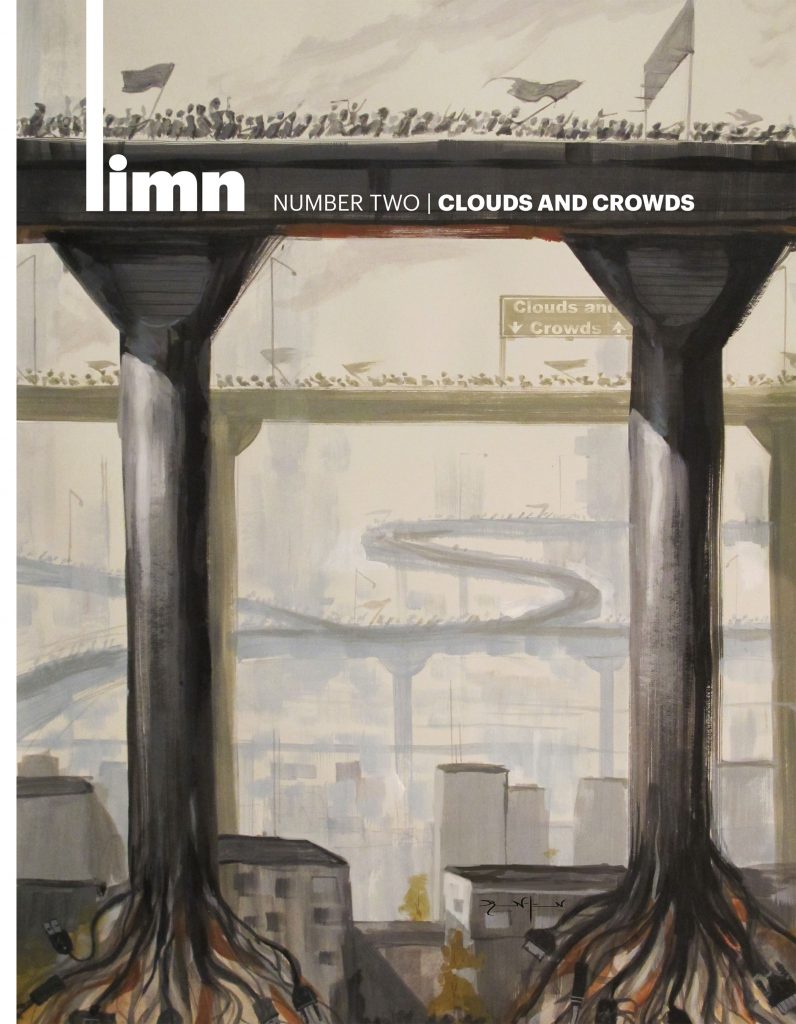

Issue no. 2: Crowds and Clouds

This issue of Limn focuses on new social media, data mining and surveillance, crowdsourcing, cloud computing, big data, and Internet revolutions. Rather than follow the well-worn paths of argument typical today, our contributors address the problems in new ways and at odd angles: from the power and politics of statistics and algorithms to crowdsourcing’s discontents to the capriciousness of collectives in an election; from the focus group and the casino to the worlds of micro-finance and data-intensive policing. Together they raise questions about the relationship of technology and the collectives that form in and through them.

-

Issue no. 1: Systemic Risk

Systemic risk has become a central topic of expert discussion and political debate amidst the financial crisis that began in 2008, but it also has resonances across many other domains in which catastrophic threats loom – including internet security, supply chain management, catastrophe insurance, and critical infrastructure protection. In this issue, we invited scholars to contribute genealogical and conceptual framings that inform critical inquiry into this increasingly important concept. The result is not a traditional collection of academic articles but a set of brief, preliminary reflections, prepared on short notice, that address a common set of questions, along with a handful of documents, links, images and videos that illustrate different aspects of the concept.

-

Issue no. 0: Prototyping Prototyping

Before there was Limn, there were several different prototypes. The first was occasioned by a conference: on prototypes. Held in Madrid in November of 2010, and organized by Adolpho Estalella and Alberto Corsín Jimenez, it was a conference for which this issue was imagined as a kind of pre-conference publication–another riff on the prototype. Many of the problems Limn seeks to address were worked out in part through this conference and the publication: from the use of new media, to the function of conferences and conference papers, to the idea of a publication that precedes or determines a social event. Issue Number Zero was very much a prototype, and bears the traces of that concept and the discussion of it by the generous participants.