“To be rich, first build a road.”

Tianhe Road, Guangzhou. By David290

In our present era, China stands out as the paradigmatic infrastructural state: a state produced by and through infrastructure as a modern project. About 43% of China’s total investment goes towards infrastructure, or roughly $2.3 trillion. This amounts to 14% of gross domestic product (GDP), in comparison with about 2% spent by the United States (Zhang and Barnett 2014). This investment is reflected in the massive and seemingly endless major infrastructural projects that embody Chinese state power: the Three Gorges Dam, the world’s most extensive high-speed rail network, longest cross-sea bridge, Asia’s largest train station, biggest hydroelectric project, etc. In less spectacular ways, it is reflected in the role that infrastructure plays at the heart of fiscal, legal, and public transformations at all levels in the seemingly permanent reforming of Chinese economy and society. In this article I explore some of the sites where infrastructure oscillates between the spectacular and the mundane, creating new forms of publics and counterpublics that symbiotically shape a new national culture premised on infrastructural prowess.

The Chinese state’s long list of flamboyant infrastructure projects makes visible the rise of China and the distance it has covered since the beginning of the post-Mao era. This classic deployment of state power uses both awe and jobs to create a multiplier effect at the symbolic and economic levels. It also serves to make visible both China’s financial might and vulnerabilities. Infrastructure projects are spurred to ever-greater heights to keep the economy growing. The Chinese state used infrastructure investment to successfully stimulate the economy during the 1997 and 2008 financial crises, but at the unavoidable cost of pouring money into unneeded projects, making infrastructure also the visible excess of an overheated economy. As outlined in a report by economists from the Chinese National Development and Reform Commission, up to 40% of projects once begun remain unfinished; many are widely considered economically inefficient (Pei 2014).

Qianzang Railway, the highest. Photo: By Jan Reurink,Wikimedia.

Showcase projects, though, are not the meat and potatoes of infrastructure. Most infrastructure projects concern transportation, water, electricity, gas, and information at municipal levels in a rapidly urbanizing country. While the spectacular infrastructure projects make headlines, 75% of infrastructure investment in China is local.[1] Such projects are predominantly financed through local governments, part of the less visible background of fiscal policy, which is essential to understanding China’s infrastructural phenomenon. Fiscal reform in 1994 redirected tax revenue that once stayed with local governments to the central government, without a commensurate change in how the central government redistributed this money. The result was that local governments became increasingly squeezed because the central government effectively shifted the burden of paying for infrastructure, social services, and education (including school construction) onto local governments. Chinese banking law severely constrains bank loans to local governments, municipal bonds are not an option, and there are no local property taxes per se (W. Wu 2010; X. Wu 2016).

The source of revenue for cash-starved and increasingly desperate local governments lies primarily in land transfers from public to private ownership. Revenue is generated in various ways, commonly through the money a local government can generate from the difference between the compensation paid to former residents and the price charged to developers for the land, as well as increased revenue from business taxes, which is one of the few taxes that remains local rather than being paid directly to the central government. But because the central government sets limits on the amount of land available for conversion from rural to urban use, there is a limited supply of land available to convert.

Recently, local governments have found a way to commodify the allocation of rural and urban land within their jurisdiction. They issue land quota certificates to developers who “create” rural land by, for example, knocking down existing structures in an officially urban area to “empty” it; they then reclassify the land as rural, and transfer the “quota” to an urban area. They can then spatially manipulate rural and urban designations for development. These certificates function as a market solution to a command economy legacy, as they themselves can be traded on an exchange in the manner of pollution credits (Cui 2011). As Yuan Xiao (2015:2) writes, “such a transfer does not trade actual land parcels, but rather virtually transfers development permission from the countryside to cities” and effectively increases both local government control over land while redirecting resources to urban areas (see also Xiao and Zhao 2015).

The search for revenue has become the motor driving China’s urban form by inexorably turning formerly rural land on the outskirts of cities into factories, eco-cities, high-rise suburbs, shopping malls, golf courses, theme parks, and business districts, all needing to be connected to electrical grids, water and sewage, transportation, and telecommunications. This too requires raising money. To finance infrastructure, local governments developed a Chinese variation on the public–private partnership model. In the absence of municipal bond markets, many local governments create and operate so-called Local Government Finance Vehicles (LGFVs) that borrow from banks to support infrastructure projects. The politics of financing infrastructure—including the role of former state-owned enterprises, the use of shadow banking, relations between companies and politicians, the awarding of contracts, and the creation and enforcement of regulations—become a focal point for the politics of urban life.

To acquire more land to transfer, and therefore raise more revenue, cities expand their borders to encompass ever more rural areas such as Chongqing, the largest single municipality that now encompasses 31,816 square miles. In the center of the city, old residential neighborhoods become prime targets for redevelopment for skyscrapers and shopping malls, while villages are swallowed by expanding city borders and become new ring roads and conurbations. The single most controversial part of these processes is the displacement of residents, who are offered compensation according to formulas that most always seem to undervalue their property. If residents do not accept the compensation, varying forms of pressure can be applied to convince them to leave their homes, from effectively de-infrastructuralizing their neighborhoods through the cutting of utilities, to tricking them into briefly stepping away from their homes, which are then quickly demolished before residents return (Shao 2013).[2] In such villages and quarters condemned to demolition, infrastructure literally becomes weapons of both the strong and the weak. Those with power can disable or deny basic infrastructure to force out residents without power. In response, and to continue to live, those without power then “steal back” and jerry-rig basic infrastructure.

Infrastructure thus both sunders and sutures residents in peri-urban villages and poorer inner-city residential neighborhoods into infrastructural publics and counterpublics. Infrastructure mediates their experiences with the state through their encounter with the withdrawal, denial, and demolition of infrastructure as a tactic of displacement, which often results in heightened consciousness of property rights and compensation rules and can take the form of protest and collective action. When residents are resettled, often in new high-rise enclaves, the same residents find themselves effectively forced into a new type of “legitimate” home ownership. This makes them a lower socioeconomic mirror of the new “homeowner” publics of the growing middle classes that Li Zhang (2010) has explored in her work on Kunming. As Zhang shows, the new middle and upper classes are also turned into infrastructural publics, albeit demanding services they feel are due them by dint of their status: their anger with property management companies takes form over leaking water pipes and exorbitant fees for utility hook-ups, and turns into conflicts over contractual obligations and new forms of activism and interest articulation.[3] Both those facing displacement and those buying into new housing estates are learning new forms of contestation and protest, and both require fluency with contracts, courts, and regulations.

As Julie Chu (2014) shows, the increasing role of infrastructure as a political space thus also has the effect of absorbing and diffusing politics into legal structures that deflect accountability: on the one hand, under rapid urbanization infrastructure becomes increasingly visible through its anticipation, lack, refusal, or appropriation. On the other, the agents that produce infrastructure become increasingly invisible, dispersed within a shadow infrastructure of “public notices and formal hearings, city plans, and housing documents…that routinize, if not dispel, ongoing conflicts over redevelopment by simultaneously narrowing and proliferating the sites of accountability…” (Chu 2014:355).The more bureaucratized infrastructural politics becomes, Chu argues, the more it shifts the terrain of encounter between state practices and people’s experiences to the legal sphere, where the state holds a distinct, if not ironclad, advantage in both obfuscation and interpretation. The “simultaneous narrowing and proliferating sites of accountability” introduced by bureaucratization causes the agents of infrastructure to disappear into a world of regulation and adjudication.

New China. Photo by Lain

In the more extreme cases, however, people literally become invisible. The same bureaucratic systems that draw people into the legal sphere to adjudicate their claims also provide the backdrop for regulatory failure and concomitant disasters where people die, bodies are often unrecovered, and unnamed migrant workers go missing. In 2015 there were two spectacular disasters among many smaller ones: the colossal explosions of improperly stored chemicals in Tianjin that damaged buildings more than a mile away and killed up to 181 people, and the gigantic landslide of construction debris in Shenzhen that smothered 25 acres, destroyed 33 buildings, and left at least 77 people killed or missing. Infrastructure catastrophes like these are not primarily the result of neglected and crumbling infrastructure, as in the United States. When a bridge collapsed in Harbin in 2012, it was only a year old and had cost $300 million, as widely reported in the media at the time. These disasters conjure the infrapolitics behind the infrastructure: the politics below the structures below. These kinds of disasters demonstrate how politics and infrastructure function together topologically, including the often fine line between corruption and encouraging rapid infrastructural expansion in the name of revenue, economic growth, and perceived real need. Spectacular infrastructure breakdowns sometimes show how the system works, not how it fails.

A corollary case of invisibility concerns the infamous “ghost cities” of China where new buildings are effectively abandoned before anyone ever lives in them. These are the result of urban expansion outstripping demand, resulting in empty streets, libraries without books, museums without art, theaters without audiences, buildings without tenants. Ghost cities arise at the intersection where the need for local government revenue through urban expansion, discussed above, meets two additional factors. First is competition among municipalities for politically important national designations such as “National Central City” or “National Regional City” (F. Wu 2015:123–127). Second is the rise of the housing market as a vehicle for investment, which rests in turn on the high cultural status of apartment ownership. At the root of the ghost city phenomenon, Christian Sorace and William Hurst (2016) explain, is an urgent social need for money and prestige both for cities seeking national-level recognition and individuals seeking to buy apartments as investments, even if they are never lived in but simply resold to other investors. Sorace and Hurst argue that ghost cities are, at their core, an illusion of money and prestige not unlike a classic bubble or pyramid scheme: the distinction between “real” value and the appearance of value must be blurred both to make its accumulation easier and to forestall its collapse. The result is the illusion of infrastructure, from numerous disconnected satellite cities near major metropolises to Kangbashi, a 137-square-mile modern city built for a million yet with fewer than 20,000 inhabitants (see Shepard 2015).

Kangbashi district, Ordos City, Inner Mongolia. Photo: Wikimedia

These cases show how infrastructure in China shapes the praxis of urban formation and citizenship in addition to boosting GDP. The converse of this is the role of infrastructure as a major export product. The visibility of Chinese infrastructure financing is central to its global image: China building railroads, pipelines, stadiums, cities, and ports across Asia, Latin America, and Africa as part of direct investment and deals for access to resources; China showing international leadership through the creation of the Asian Infrastructure Investment Bank (AIIB) as an alternative means of infrastructure financing to the World Bank, the Asian Development Bank and others with their roots in the Cold War–era financial architecture; China leading the “One Belt, One Road” project that seeks to connect 60 countries containing most of the world’s population through the financing of new ports, highways, and railroads. This infrastructural foreign policy echoes, on the one hand, historical colonial projects such as massive railroad and port building in China by imperial powers. On the other, it echoes the hegemony-seeking dominance of the United States in the Bretton Woods institutions, while purporting to invert the imperialist legacy by having a former victim of imperialism lead global development.

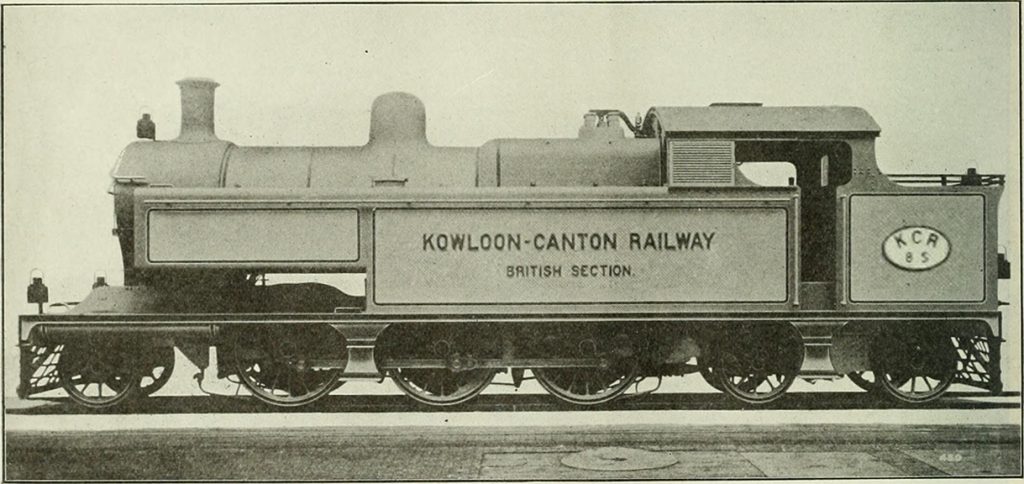

What is made visible through infrastructure both at home and abroad is thus also a redemptive narrative of the nation. One can see a certain continuity with local patriotic movements of the early twentieth century to buy out railways from foreigners who had wrung the right to build them from the weak Qing government. The first railroad in China was built by the British in 1876; by the turn of the twentieth century, 80% of railroads in China were under foreign control, either directly or through loans (Yin-Nor 2016:44–45). The subsequent dependence of China’s infrastructural development on Western technology, often in the form of colonial or, later, Soviet origins, constitutes an important historical context for contemporary infrastructural politics. In this sense, infrastructure is about reclaiming modernity as a Chinese project.

In all these cases, infrastructure appears as an ultimate fix in its multiple senses: as a form of repair for the humiliations of the past, as a solution for the economic problems of the present, as an addictive form of power and revenue generation, as a remedy to overaccumulation especially in foreign reserves, and, in the colloquial sense, as a difficult or awkward situation. It is through infrastructural fixes that the relationship between the Chinese state, its people qua publics, and the role and function of law is being formed and reformed in the context of new narratives of the nation.

China is the paradigmatic infrastructure state, yet it is also paradigmatic of the state of infrastructure today: a complex juxtaposition of sites that generate publics and counterpublics and which, taken together, confound straightforward ideological instrumentalization.

In this juxtaposition of sites, we see how the intertwining of different infrastructural inheritances produces the modern Chinese state. Like the infrastructure it promotes, the state strives to be both visible and invisible at the same time. It is by looking at the junctures of visibility that we can see the genealogies, trajectories, and possibilities of the structures below.