Public infrastructure is back on the African development agenda. So, it seems, is public debt. In 2010, a team of researchers at the World Bank completed “Africa’s Infrastructure,” a widely influential report that estimated the continent would require an additional $31 billion per year in the next decade to close Africa’s growing “infrastructure financing gap.” The report, and many that have followed it, frame today’s infrastructural problem in terms of finance: How are African governments going to access enough capital to meet large-scale infrastructural needs? In response, 14 African governments have issued their first sovereign bonds on European and American securities markets totaling around $25.8 billion in new debt, most of which is intended to fund infrastructural investments (Adams 2015). And subnational governments, such as municipalities, are quickly following suit. Today, there are more African governmental bond issuances than ever before, and a flurry of policy reports, conferences, and visioning documents that herald bonds as an “innovative financing solution” to the continent’s perennial infrastructural ills (see Guttman et al. 2015).

Fig. 1: Images of public works used in the Gabonese state’s online advertising for the initial public offering of its sovereign bonds. Translations: Road Network Development; Watershed Construction; Fiber Optic Construction, Connection to the Electrical Network. Source

But who will own Africa’s infrastructure? This question of ownership is at the heart of debates about how public services are provided today. Many scholarly and popular critiques of public infrastructure focus on how ownership has changed hands from a public entity (like a state) and shifted to a private entity (like a firm). This is commonly referred to as privatization. In Africa, such critiques dominated public debate in response to the debt crisis of the 1980s. As governments defaulted on existing development loans, scholars and activists alike criticized development banks for imposing fiscal austerity through new, conditional loans that required the sell-off (i.e., privatization) of state assets such as infrastructure. But issuing African governmental bonds does not result in the privatization of public infrastructure; in fact, African infrastructure is still overwhelmingly public. Most expenditures on energy, water, sewage, and roads on the continent are funded with or subsidized by tax dollars, and are subsequently owned by African governments (Foster & Brinceño-Garmendia 2010). But private investors can increasingly own state debt as a financial asset, and this debt is linked to a new way of understanding—and providing for—the African public.

Bonds suggest a potentially new role for private ownership in African public infrastructure and public finance. Yet this is not the only or even the most important story about ownership in African infrastructure today: governments and development institutions are also articulating new notions of and techniques for the African ownership of infrastructures and debts. This vision of African ownership is reflective of the broader reorientation of development values in Africa toward development “Beyond Aid.” In a 2010 keynote address of the same title, Dr. Ibrahim Mayaki, CEO of the New Partnership for African Development (NEPAD), outlined a vision in which development is “the result of African efforts that aim at utilizing innovative financing mechanisms…particularly domestic resources” (Mayaki 2010). Speaking to “Africa” in general, Mayaki’s address calls for a style of development in which “aid is no longer the primary determinant of policy design” and instead, “the private sector, civil society, and the regional economic communities are…taking firm ownership” (2010). Spanning both the public and private, Mayaki’s broad vision implores Africans to take ownership of planning Africa’s infrastructural development. In common usage, the word “ownership” denotes the legal possession of property. But it can also be used, as Mayaki does, to imply a more general sense of belonging: in this case, belonging to—and by—the more general “we” of Africa.

Participation as Ownership

Although Mayaki’s vision for African infrastructure development self-identifies as “new,” it is part of a Pan-African ideology that is not. Pan-Africanism is a long and diverse intellectual and political movement that, in the mid-twentieth century, played a key role in anticolonial resistance and national independence in Africa. Member-states subsequently institutionalized Pan-Africanism into the Organization of African Unity (OAU), which in its political platform prioritized the sovereignty of nation-states. But critics of the OAU note that the defense of national sovereignty often entailed the de facto defense of national dictators who, by the 1990s, were responsible for the deaths of millions of their own African nationals (Murithi 2007). Although Pan-African in name, critics argued that the OAU was not so much a shared vision for African unity, but instead, as one scholar calls it, a “toothless watchdog” that was “perceived as a club of African heads of states, many of whom were not democratically elected representatives of their own citizens, but self-appointed dictators and oligarchs” (Murithi 2007:3).

Such critiques of the OAU, of course, are themselves invested in a different vision of African unity, a vision that, in 2002, member-states intended to realize by forming the African Union as a new, more democratic successor to the OAU. The Constitutive Act of the African Union outlines not only the familiar objective to “defend the sovereignty, territorial integrity, and independence of its member states,” but also to “promote democratic principles and institutions, popular participation, and good governance” (African Union 2002). Today, the African Union is extending this new vision of democratic participation and political unity into “technical” development planning via NEPAD, the self-described “technical body of the African Union.” NEPAD officials quite explicitly “believe that infrastructure development is the key to all aspects of social and economic transformation” (Mayaki 2014). And the Programme for Infrastructure Development in Africa (PIDA) is NEPAD’s central, collective effort for planning the continent’s physical infrastructure. PIDA prioritizes infrastructure as part of “a common vision of regional integration” (African Union 2010:3) with an overall aim to “finally build [the African] common market” (African Union 2010:2).

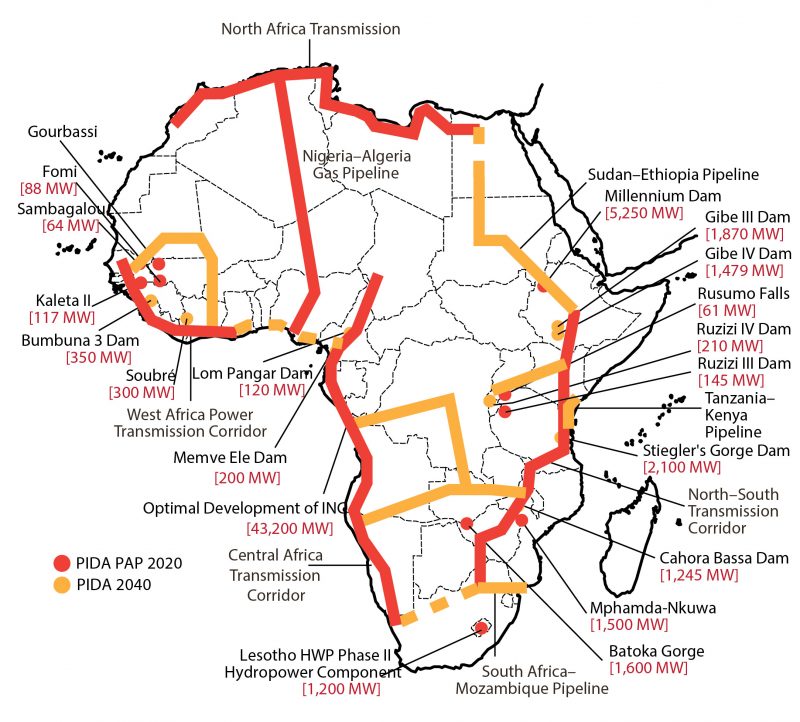

Fig. 2: “PIDA’s Energy Impact” from the African Union’s vision statement, “Programme for Infrastructure Development in Africa: Interconnecting, Integrating, and Transforming a Continent,” pg. 12

Although this belief in physical infrastructure development is at the core of PIDA, infrastructure is not a particularly new addition to economic development practice in Africa. Instead, the novelty of the “new partnership” is in how the program goes about setting priorities and whom it includes in the process. Here, it is the participatory nature of PIDA’s planning process that officials anticipate will provide a sense of “ownership” among its regional stakeholders. In one sense, the program is simply a list of 51 projects. But in another sense, it represents “what makes PIDA unique and what will help ensure its continuing relevance and support: African ownership” (African Union 2010:4). NEPAD officials claim that the participatory nature of PIDA’s planning process gives African institutions “ownership” over the plan itself. From this perspective, ownership is a sense of propriety and belonging that derives from the collective act of participation. And the resulting African “ownership” of infrastructure planning is a cornerstone of the program’s efforts to realize the African Union’s broad political mission of continental integration.

PIDA’s planning process culminated in the Priority Action Plan (PAP), a continually updated list of priority projects. Ninety-five percent of these infrastructures are in the energy and transport sectors, including projects like the Great Millennium Renaissance Dam in the Nile River Basin, a plethora of transregional highway corridors, a 15-country port upgrading program across all of West Africa, and even the Single African Sky program, which would create a “high-level” satellite-based air navigation system for the entire continent (African Union 2010:18). Despite having finalized this expansive and ambitious list, the program emphasizes that the PAP is a dynamic document that “should be viewed not as a single list cast in stone,” but as a first step in delivering the PIDA program (African Union 2010:5). And PIDA’s vision statement argues that it is precisely this dynamism that undergirds the program with a “sense of well-studied pragmatism and African ownership” (African Union 2010:10).

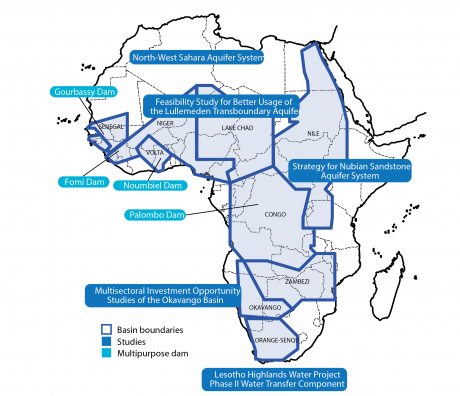

Fig. 3: “PIDA’s transboundary water Impact” from the African Union’s vision statement, “Programme for Infrastructure Development in Africa: Interconnecting, Integrating, and Transforming a Continent,” pg. 14.

PIDA argues that its infrastructure priorities are based on a “detailed empirical foundation,” developed from an 18-month research and diagnostic review (African Union 2010:4). But program officials also claim to have combined this analytical effort with an extensive and painstaking participatory process. In July 2011, PIDA brought stakeholders together in Tunis for a high-level technical meeting to agree on the strategic framework and project selection criteria. The project report claims that participants came to a consensus on three central project criteria: eligibility and regional integration; feasibility and readiness; and development impacts. Although it is not clear from PIDA’s reports exactly which stakeholders were present at the high-level technical meeting or how they came to such a consensus, PIDA officials still argue these criteria came from a “bottom-up” process that, later in 2011, also included two-day consultations with a further set of stakeholders in Nairobi (Kenya), Libreville (Gabon), Abuja (Nigeria), Yamoussoukro (Côte d’Ivoire), and Rabat (Morocco). It is this consultative process that PIDA claims, “…led to a continent-wide consensus” and “…laid the foundation for continuing ownership through all phases of implementation” (African Union 2010:4).

But who, exactly, are the stakeholders that “own” PIDA’s planning? In contrast to the African Union itself, PIDA is not a federation of nation-states. Instead, its stakeholders are “the Regional Economic Communities (RECs), the power pools, the lake and river basin organizations, specialized agencies, sector ministers and other relevant development stakeholders” (African Union 2010:4). A report on PIDA’s consultative process states that its meetings “assembled more than 300 representatives of the RECs and their agencies, along with representatives of 36 governments” (SOFRECO 2011:44). PIDA explicitly organizes a greater role in the planning process for regions and regional institutions. To PIDA, closing the infrastructure deficit is “a regional and continental problem that requires a regional and continental solution” (African Union 2010:2). Yet some critics argue that PIDA’s set of regional stakeholders is not extensive enough.

In two open letters addressed to NEPAD’s Head of Infrastructure and the United Nations Economic Commission for Africa, a group of self-identified “civil society actors,” implored officials to evolve PIDA “in a more transparent and participatory way,” saying that an “open and transparent engagement between civil society and PIDA decision-makers will be important to demonstrate respect for democratic decision making” (Alexander et al. 2014). Led by the South African office of the Heinrich Böll Foundation, this group of civil society actors also critiqued the content of PIDAs action plan as “infrastructure mega-projects” that may “exacerbate the colonial patterns of extraction” with a limited focus on natural resources and export-based growth (Alexander et al. 2014). And a further report by the foundation argues there is a disconnect between continental decision-making and the “domestic level” where negative impacts like displacement and environmental damage are “felt the most” (Qobo 2014:2). Such critiques focus attention on a different scale of ownership—“citizen ownership”—that, they argue, is excluded from PIDA’s limited set of regional stakeholders. At the same time, it is precisely PIDA’s stated value of democratic participation that opens up “ownership” to these kinds of public debates.

Ownership as Participation

Fig. 4: A full-page advertisement for Gabon’s initial public offering of sovereign bonds published in the late-May 2016 issue of Jeune Afrique.

Despite PIDA’s emphasis on “ownership” of this planning process, its stakeholders envision African national governments as the legal owners of infrastructure projects as property. The RECs, in addition to a novel panoply of civil society and private sector organizations, are the core stakeholders involved in the planning, monitoring, and debating of Africa’s infrastructure. But PIDA’s vision statement outlines that, in fact, it is “countries that will drive and own projects,” and that “funding will rely on strong and committed national leadership” (African Union 2010:6). Thus, African governments will be owners too, but will be additionally responsible for the debt needed to close the “infrastructure funding gap.” In response, governments are also linking the language of “participation” to this more legal sense of “ownership” in the continent’s growing securities markets; in this case, the ownership of sovereign bonds. In this emerging vision of “domestic finance,” the African public itself will be able to purchase—and subsequently own—the state debt required for infrastructural investments. And African governments are framing the ownership of this debt as a way for the public to participate in African development itself.

Gabon’s marketing campaign for its 2016 issuance of sovereign bonds is exemplary in this respect. Unlike most sovereign bonds in Africa, this bond was not issued on European and American markets, nor was it issued in a foreign currency. Instead, this bond—the Gabonese government’s third in as many years—was issued on the Securities Exchange of Central Africa (BVMAC) and is denominated in the Central African franc. Although the government’s issuance was a call for private investment, the call itself was made to the African public more generally. A full-page advertisement for Gabon’s bond appeared in the late-May 2016 issue of Jeune Afrique, a widely read African business and politics periodical. Although it is not the first advertisement for such bonds to appear in the magazine, it is exemplary in its imagery and language (Figure 3). Scrawled across the ad are two large, blue texts that read “Participons au développement” (“Let’s participate in development”) and “Valorisons notre épargne” (“Let’s promote our savings”). The government also maintains an astonishingly well designed and accessible website dedicated to the bond issuance. Like its print version, the bond’s online marketing uses the colors of the Gabonese flag and adds a constant rotation of images of infrastructure projects in which the funds from the issuance will ostensibly be invested (Figure 1).

Similar to PIDA’s planning process, Gabon’s marketing program addressed potential investors by using the language of participation. This seems to have garnered widespread interest, considering the bond was 138% oversubscribed, allowing Gabon to take out significantly more debt than was originally on offer. Ironically, Gabon’s marketing campaign was quickly followed by a contested and violent presidential election, itself framed in the press as a crisis of democratic participation (see Bavcon 2016). Nevertheless, the campaign implored investors to participate in development by owning bonds. Moreover, this marketing addressed multiple scales of ownership: whereas “development” calls up the national infrastructure projects proposed in the bond details, “our savings” is referencing not a national, but the regional currency and regional securities market. And the third-person imperative (participons/valorisons) suggests that these collectivities are doing the participation and promotion together. Further, its publication in Jeune Afrique also suggests a continental elite audience to which the marketing campaign was also addressed. Although other governments have hinted at this kind of participation by ownership, Gabon used this language and imagery as a cornerstone of this marketing campaign for its sovereign bonds.

Gabon is a positive example of an emerging model of development finance focused on “domestic finance.” But it is not yet exemplary of how most African sovereign bonds are issued today. Many development experts applaud the expansion of bond issuances as a useful and innovative private sector solution to today’s lack of infrastructure finance. And more than an injection of private wealth, bonds are also an injection of private sector principles in which governments and their projects are evaluated in terms of profit, productivity, and financial risk. Many others, of course, critique bond financing for these very same reasons. In fact, a host of prominent critics argue that the recent rise in sovereign debt today portends a second round of African debt crisis reminiscent of—if not worse than—the crisis of the 1980s (Stiglitz & Rashid 2013; Walker 2013). But in contrast to the more familiar development bank loans of the 1980s, today’s loans are increasingly derived from private investors buying up debt as a risky, high-yield asset on European and American securities markets. From one perspective, the rise of state debt in Africa is part of a broader story of global economic imperialism in which Euro-American finance capital responds to crisis at home by seeking higher returns on investments in far-flung, frontier markets abroad (see Harvey 2003).

But African governments—such as Gabon, Ghana, and Senegal—and development experts are creating a kind of African infrastructure finance that is very different from the existing practice of Western investors and vulture funds buying up risky public debt. There is nothing short of an avalanche of policy reports, workshops, and media coverage across a variety of developmental domains that take “domestic capital markets” and “domestic finance” as the innovative development solution of the future. And European, American, and African institutions together have converged on this growing consensus. Although African governments like that of Gabon are infusing capital markets with a kind of collective vision, economists also suggest that domestic bonds make rational, economic sense (Tyson 2015). When African governments issue bonds in foreign currencies such as U.S. dollars, there is a risk that the exchange rate will change by time the bond matures. And paying back international debt with a devalued currency can significantly increase the costs of borrowing and can decrease the value of the bond itself. Issuing in a domestic or regional currency, of course, eliminates this risk. Despite the European and American provenance of the virtues of domestic finance, African governments and Pan-African institutions are taking up this transatlantic convergence of development expertise and enrolling it in broader values of African unity, collective development, and ownership.

Taking Ownership

More than a story of contemporary Africa, today’s infrastructure planning and finance are also part of a more general history of democracy and markets, core values of modern liberalism. Instead of understanding such global encounters as a straightforward expansion of liberalism, scholars have encouraged us to explore how these movements might reconfigure liberal values themselves (Appel & Kumar 2015; Collier 2011). And scholars of Western modernity argue that civil society, markets, and the publics that constitute them are at the heart of the modern liberal imaginary (Taylor 2003). Yet African institutions are taking up these forms and providing a contrasting vision and ownership of modernity, inflected with long-held, anticolonial, and Pan-African political values. However, the reverse is also evident: the belief in democracy and markets is infusing African infrastructure planning and African unity with a hefty dose of liberal values. This explains some of the purchase these programs have among a familiar cast of decidedly liberal “development partners” like the International Monetary Fund, the World Bank, and even private foundations like the Bill & Melinda Gates Foundation. And institutions like NEPAD envision re-configuring this mix of values through the technical provision and planning of physical infrastructures, which have long been understood as key symbols of modernity and modernization on the continent (Larkin 2008).

Africa is not a country. But Africa is and has been imagined as a political collectivity, once as a federation of nations and perhaps today as a continental network of financial markets, “new” partnerships, and the physical infrastructures to match. African officials like Mayaki view this new configuration of African ownership as an intentional departure from the previous era of structural adjustment programs imposed by the World Bank. Mayaki himself sees structural adjustment as an “erasure” of Africa’s capacity to “prioritize and think strategically,” and argues that institutions like NEPAD are here to “fill the vacuum” (Mayaki and Abdelaziz 2013). African ownership of infrastructure-led development is one such attempt to fill this void that has only begun to emerge since the turn of the new millennium. But this new vision of African-owned development also opens up a different set of possibilities and pitfalls: How far will the language of participation be extended to broaden—or curtail—public input in technical development plans? And how and to whom might these publics make claims? How will African regulators keep up with a rapidly changing terrain of interconnected and cross-border financial markets? And what kinds of continental systemic risks and intra-Africa debt crises might this entail (Enoch et al. 2015)? And how might all of this create new fissures in what is today a rather clean vision of African ownership, partnership, and unity?