As far as consumption choices go, electricity usage might seem uncomplicated. We don’t shop for electricity: we receive it at home or at work, we get the monthly bill in the mail, and we pay it. What the bill doesn’t reflect is the tremendous change in electricity infrastructure in the twenty-first century. Today, more and more electricity in the United States is bought and sold in seven competitive electricity exchanges before being delivered to consumers. Once widely believed by economists to be a natural monopoly good, electricity is now groomed as a market commodity par excellence. The burden and risk of creating organizing frameworks for buying and selling electricity now falls on a new, dispersed set of experts: electrical engineers who design markets (engineer-economists, if you will), traders employed by the buyers and sellers (i.e., generators and utilities), and computing experts who assist both market designers and traders. Even as electricity expertise splinters, these experts work together to create an infrastructure to transform both electricity producers and the electricity-consuming public into calculating economic actors. Whereas competition was once precisely the peril against which regulation was meant to protect producers and consumers, it is now seen as the safeguard of public good: the guarantee of efficiency and affordability for both producers and consumers. I find in my ethnographic research that the landscape of electricity is populated by new kinds of experts who promulgate this particular vision of competition and, importantly, discontented citizens.

For most of the twentieth century, economists and regulators considered electricity unsuited for competition (see Özden-Schilling [2015] for the origins of electricity’s “natural monopoly” status). Large, vertically integrated companies produced, transmitted, and distributed electricity free of competition in delimited territories prescribed by state regulators. The transformation that recently occurred in the American electric infrastructure has a familiar alias: deregulation. Its origin story also fits the bill: the 1992 Energy Policy Act repealed restrictions on electric utilities to trade with each other—restrictions introduced under the New Deal—and allowed states to break up their monopolist utilities. The Federal Energy Regulatory Commission (FERC) followed suit in 1996 by announcing that it would allow nonprofit private companies to operate the electric grid as independent system operators (ISOs) and run markets simultaneously. Separate producers and distributors of electricity could now enter the industry as buyers and sellers of wholesale electricity. With prior regulations removed from the picture, markets could reign free. At least, that’s what it looked like to critics who described deregulation (and its patron ideology, neoliberalism) as merely a negative, destructive process and as the “withdrawal of the state from many areas of social provision” (Harvey 2005:3; for a critique of this view, see Collier [2011]).

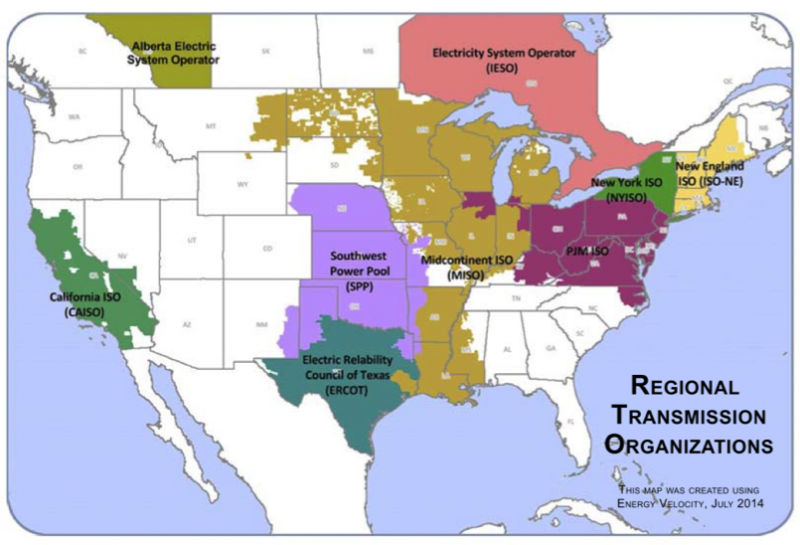

Figure 1. There are seven transmission operators in the United States, each of which operates an electricity market.

On a second look, deregulation is, in fact, regulation reshuffled, or regulation reassigned and redistributed to new actors. In the earlier regulatory environment, established during the New Deal, state regulation commissions functioned on the premise that utility companies had to be kept in check to secure public interest, which was reliable and affordable service. More often than not, they advanced the interests of the companies that welcomed the lack of competition and enjoyed close relationships with long-sitting regulators (Rudolph and Ridley 1986). Regulation now functions on the premise that competition enables both producers and consumers to perform at their best while also securing public interest in the form of reliability and affordability. Accordingly, the expertise required to circulate electricity freely and competitively itself should emerge competitively, and as such, cannot be contained in predetermined, centralized venues such as state regulation commissions.[1]

Today, there are seven ISOs across the country, each of which runs an electricity market and operates the grid based on market results. ISOs are responsible for the grid’s long-term reliability, maintaining transmission lines and adding new ones as necessary. Although only 16 states so far have forced their monopolist utilities to unbundle,[2] electricity markets run by ISOs have grown to swallow those states that have not; they now cover all or parts of nearly 40 states. (There is no requirement for companies to unbundle to join ISOs. Therefore, for instance, a vertically integrated utility in New Hampshire, where deregulation has not occurred, still has to compete with other sellers and buyers across the six states that fall under ISO–New England’s territory.) Across the ISOs’ collective 2 million square miles of territory, state regulators now fulfill tasks that are derivatives of ISOs’ functions: ensuring that utilities’ retail prices do not diverge significantly from wholesale prices emerging in ISO-run markets, or approving—usually without a fight—ISOs’ plans to expand the grid by adding new transmission lines.

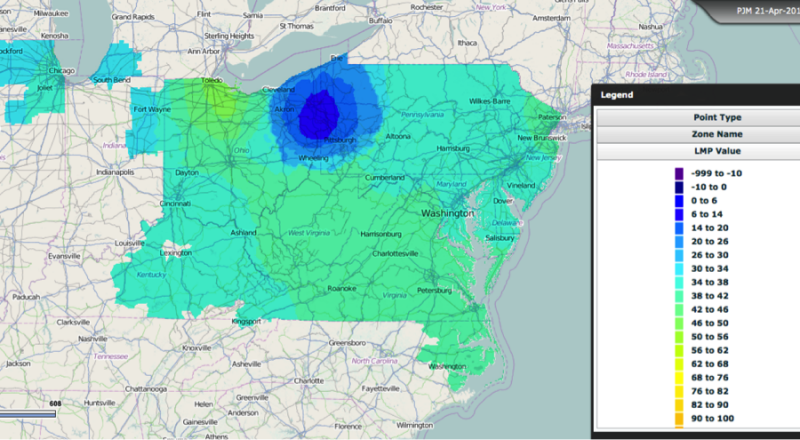

Figure 2. Snapshot of the thermal map of real-time LMPs taken on 21 April 2014 at 07:35 PM.

Regulators and the lawmakers who passed the Energy Policy Act of 1992, while familiar with electricity’s quirks such as its land-boundedness and inability to travel more than a few hundred miles, were not fluent in the physics of electricity’s exchangeability. At neither the state nor federal level did lawmakers propose the physical specifics of how a new regime of electricity with a multiplicity of buyers and sellers could be governed. What if, for instance, the intersection of electricity’s supply and demand, where theoretically the competitive price must emerge, yielded a supply that transmission lines simply could not carry? New experts have emerged as the regulators of neoliberal electricity to answer such questions. Some even explored a competitive avenue for electricity exchange and helped shape lawmakers’ opinion in favor of deregulation well before deregulation became a legal possibility. In the early 1980s, a group of four academics based at the Massachusetts Institute of Technology and headed by Fred Schweppe, a professor of electrical engineering, sketched a spot-pricing mechanism to honor the physics of electricity as well as the textbook purpose of prices according to microeconomics: to reflect the varying costs of injecting and withdrawing electricity at different locations. A member of the group described the process to me as the “gluing of engineering and economics.” A new kind of economics, one informed by the basics of microeconomics yet mindful of the physics of electricity, was in the making.

Today, all seven electricity markets in the United States use a mechanism called locational marginal prices (LMPs) that draws heavily on Schweppe’s team’s projections. LMPs are prices assigned to every designated “node” in the system (the substations where electricity is injected and withdrawn, and voltage is readjusted). Because LMPs are location specific, they are meant to reflect the varying costs of withdrawing and injecting electricity at different nodes of the grid that differ due to transmission line congestion in high-demand areas. With LMPs, Schweppe’s team aimed to honor the economic view that prices are vehicles of information about the changing conditions of supply and demand on the ground. In the process leading up to April 1998, when the first American electricity market came online in California, electrical engineers like Schweppe accomplished the critical task of supplying ISOs with the mathematics of potential market arrangements. These engineers adopted the tools of economics—albeit in simplified, stripped-down articulations—and drew on economics as a discursive resource in their rhetorical advocacy for the introduction of competition. When one follows this kind of expertise, the history of deregulation only begins where critics like Harvey (2005) claim that it ends.

The influx of information workers into the electricity industry is the first tangible change that occurred in the twenty-first century in the United States. To be exchangeable, electricity must be standardized not only in terms of its physical properties (e.g., voltage and frequency, the standardization of which was already accomplished by the end of the nineteenth century when electricity industrialists built and connected large grids), but also in its computational representations. The buyers and sellers of electricity employ traders, who code electric flows into digital databases to forecast LMPs and make buying and selling decisions. Their models incorporate mountains of carefully organized data about electricity suppliers’ and buyers’ properties and patterns of behavior. The neoliberal market appears as an “information infrastructure” (Bowker et al. 2010:98), which keeps the various actors that exchange electricity in computational tandem. The traders and market analysts often refer to the “granularity of data,” the endless process of refining models, adding in relevant data, and weeding out the irrelevant, all with the goal of producing a more accurate forecast of LMPs. They feed their computerized LMP prediction models with data that go into market participants’ bids and offers, such as generator fuel types, utility locations, and weather forecasts (since demand correlates strongly with weather). This work requires constant database building and maintenance. In contemporary electricity markets, the burden of organizing information is transferred from a central authority onto market actors, who, as data processors, turn commodities like electricity into computationally standard representations.

While traders primarily navigate these computing infrastructures, engineers work to enhance the physical infrastructure of the market: the electric grid. A “smart grid” is often defined as a grid upgraded with communication and information technologies. The smart grid, as imagined by engineers, also corresponds to an enhanced marketplace where communication and information technologies serve to better balance supply and demand. Smart grid engineers technologically intervene to decentralize the grid for better information circulation and better balance of supply and demand. Their project amounts to fashioning the grid in the image of a market as imagined by the economist Friedrich Hayek. In praising decentralized networks of information circulation, Hayek conceptualized the market as an information infrastructure reflecting the ever-changing supply and demand conditions on the ground that would be otherwise unknown to a central planner (1945). Similarly, smart grid engineers let various actors across the grid constantly exchange information (automatically, not personally) through technological devices, bypassing the ISOs’ computers. In a more ambitious move, by designing new structures for monitoring consumer demand, smart grid engineers work to interpolate electricity users—all of us—into the domain of this enhanced marketplace. With the use of household devices, they hope, consumer-citizens who were relegated long ago to a passive relationship with the grid (i.e., receiving and paying a monthly bill) will soon be able to respond to real-time prices. Designs for household applications, like refrigerators and electric vehicles that solve optimization problems in constant communication with each other, are at a conceptual stage, yet they herald a new era that expands the domain of economic calculation and communication.

The new vision for electricity is scarcely challenged in the expert circles I outline here. But this vision does not address many political questions that saturate consumers’ relationships with the grid. Consumers, cooperatives, and other public forces protested the previous regulatory regime because it was dominated by corporate interests (Rudolph and Ridley 1986); today, consumers might still find decision-making mechanisms located in ISOs and regulatory bodies out of reach. If we live in the countryside or the suburbs, we might find our landscape shot through with the metal bulk of the electric grid—transmission lines, towers, and substations—and our local energy sources depleted to produce electricity that bypasses us to go straight to centers of demand. The experts of the new regulatory environment, like the smart grid engineers focusing on household technologies, want us, the electricity consumers, to start reacting properly to prices, yet their models do not include new processes for us to learn how the prices are set or to protest when the prices pass utilities’ costs onto us, or a mechanism with which to negotiate which costs they (and hence we) assume. While the experts are hoping to expand the domain of the economic to include our households, an emerging counter-public asks if the domain of public contestation and negotiation could be expanded instead.

Citizens and transmission lines, coexisting uneasily in West Virginia.

A growing community is now after an alternative “economic imagination” (Appel 2014) for electricity, creating niches of possibility for alternative electric futures. These citizen activists were jolted into electricity politics in recent years when massive new transmission lines were proposed to cut through their neighborhoods. In 2007, the citizens of West Virginia’s Jefferson County learned of the Potomac-Appalachian Transmission Highline (PATH), a proposed 765-kV line to deliver the cheap coal power of West Virginia 275 miles east to demand centers on the Atlantic coast.[3] Once the ISO approved the line as a requirement for the grid’s future reliability, they were told, it would acquire the privilege of eminent domain. Wary of accusations of self-interested “NIMBYism,” the organizers—mostly women—questioned whether the line was necessary at all. The difficulty of countering engineering arguments, of course, is part of how nonspecialist citizens often find themselves outside decision-making mechanisms.

While dedicating themselves to online, self-directed research into the obscure regulations governing ISOs during the five-year battle that followed, the StopPATH movement has managed to reveal the line’s role in the ISOs’ economic functions and democratic dysfunctions. ISOs were promoting the delivery of electricity over long distances to enable long-distance trade: by bringing prices closer across large territories, long-distance lines would give producers far from demand centers a chance at increased profit and further the ISOs’ goal to boost competition. On the other hand, when electricity travels over a long distance, the decision-making mechanisms also move farther and farther away from affected communities, to places where citizens do not hold voting privileges or access to representation. Carrying “coal by wire,” as they put it, the line would both use up local resources in West Virginia and, in the long term, raise electricity prices for West Virginians by bringing them closer to those in demand centers, all without citizens’ meaningful participation. Couldn’t electricity flows and decision making take place, StopPATH asked, in shorter and more accessible circuits?

In 2012, the ISO (PJM-Interconnect) cancelled PATH, although without acknowledging StopPATH’s savvy, engaged activism at the county, state, and federal levels. The movement remains active; its members have since refocused their efforts onto other electricity-related matters[4] and allied themselves with similar movements across the United States, including an Illinois-based group currently fighting against the construction of the Rock Island Clean Line (RICL). In questioning the need for a new transmission line to bring electricity from proposed wind power plants in Iowa to already wind-rich regions of Illinois, Block RICL[5] asks if the only way to introduce more renewable energy into the grid necessarily involves reinforcing a politically failing system and destroying, in RICL’s case, thousands of acres of what they say will become a “nonrenewable” source of life upon the construction of the line: farmland.[6] Both groups are adept at locating electricity in the larger world of energy flows, though the ISOs continue to ignore their proficiency. While their proposed solutions often include a distributed vision for electricity production in a way that might echo the experts’ vision for electricity, their approach to distributive justice is different in scope: it demands a distributed vision for political representation and an interrogation of the vestiges of the old electricity regime still upheld in expert designs such as strict divisions between producers and consumers, and electricity’s status as an object of profit before a good for collective life.

To understand the new infrastructural landscape of electricity, I suggest following both experts as they tweak electricity to enable neoliberal relationships and citizen groups as they pose democratic challenges to that project. Such a task is critical to understanding how electricity flows are organized to generate new understandings of expertise and publics. It may help us not only to attend to the making of neoliberalism on the ground, but may also help us understand its limits. A new, more critical look at your electricity bill is in order.