Cushing, Oklahoma, is a town with fewer than 10,000 residents. Despite its modest population, the self-proclaimed “Pipeline Crossroads of the World” holds an outsized importance in the oil industry. As the gathering point for much of the oil produced in the Continental United States, Cushing is served by a host of major pipelines (including branches of the Keystone Pipeline built in 2011 and 2014 before the proposal of the controversial Keystone XL Pipeline) and possesses a combined storage capacity of nearly 100 million barrels. But even with its elaborate pipeline network, increases in supply, or a softening of demand for oil can turn Cushing into a bottleneck that traps petroleum at the source of its production.

Pipelines can facilitate the flow of oil to markets, but they can also serve as chokepoints that prevent it from flowing. In some cases, such as an oversupply in Cushing, the reason for a stoppage is based in limits of physical capacity: too much oil, too little pipe. Yet in many cases, such chokepoints are deliberate rather than accidental. Throughout history, oilmen have frequently used the construction—and just as importantly, the deliberate non-construction—of pipelines to advance their own interests. Real money and power in the oil industry has historically been generated not only from delivering a product to market, but, just as crucially, from preventing others from doing the same.

To understand why, it is helpful to remember two interconnected features of the oil industry since its inception in the mid-19th century: abundance and low cost. While episodes of skyrocketing prices draw headlines, the reality is that petroleum has been a remarkably cheap commodity for most of the last century and a half. High prices have been an exception rather than the norm. While low prices usually benefit consumers, they are the bane of producers, as they reduce profit margins.

Pipeline Monument, Cushing, Oklahoma. roy.luck

As a result, limiting the amount of petroleum reaching markets has long been a preoccupation of major players in the industry. Within oil circles, anodyne phrases such as “balancing supply with demand” or “market optimization strategies” provide an anaesthetized view of this process. More provocatively, Timothy Mitchell has recently labeled this practice “sabotage,” noting that “the goal of oil companies was to place themselves in control of the conduits, processing points and bottlenecks through which oil had to flow, to restrict the development of rival channels … and to use this command of obligatory passage points to convert the flow of oil into profits.” For major oil companies, the “paramount aim was to impede the flow of energy and increase its cost” (Mitchell 2011: 40, 45).

The creation of OPEC (Organization of Petroleum Exporting Countries) in 1960—a cartel seeking to curtail output in order to raise prices—is perhaps the most famous example of oil producers organizing to limit production. But they were not the first. In the 19th century, John D. Rockefeller recognized that governing the transport and refining of oil would enable him to restrict the flow of oil to markets, thereby increasing the profitability of his Standard Oil Company. Then as now, pipelines were one of the most effective weapons in this effort.

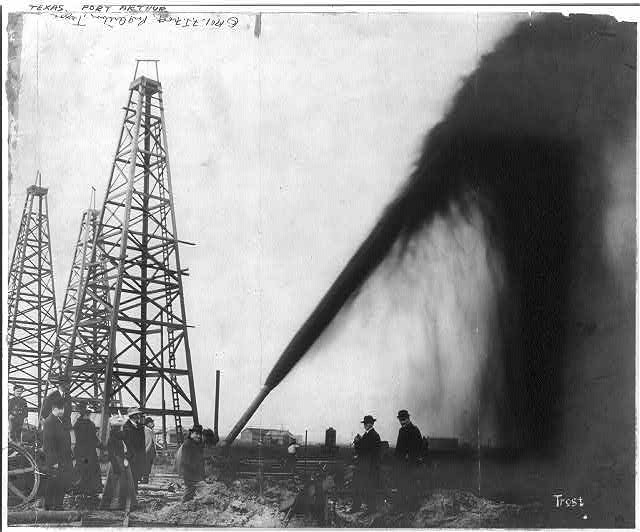

Consider the world’s first long-distance pipeline, which was completed in Pennsylvania in 1879. Before its construction, oil was transported overland by railroads. At the time, there was no notable shortage of capacity nor were the transport costs too high for consumers: kerosene refined from crude petroleum and used for lighting was already far cheaper than alternatives such as whale oil or camphene. Yet there was a chokepoint, just not a physical one: Standard Oil’s industry dominance of railroad transport.

For observers of America’s booming oil industry following the first successful drilling for petroleum in 1859, the rise of Rockefeller’s empire elicited mixed feelings of awe and indignation. Starting with a small refinery in Cleveland in the early 1860s, Standard Oil had obtained control of more than 90 percent of America’s oil-refining capacity less than two decades later. Unique advantages in railroad transport played an essential role in this rise. Using his large volume of oil shipments as leverage, Rockefeller negotiated bulk discounts with railroad carriers, threatening to take his business to another railroad if they refused to comply. These lower transport costs helped Standard Oil outperform its competitors, thereby increasing the company’s share of the trade. This generated a self-reinforcing cycle: ever-increasing shipments generated ever-greater savings on transport costs, which further enhanced Standard Oil’s competitive advantage. Ultimately, Rockefeller possessed such a large share of the market that he not only received large rebates, he also forced railroads to give him drawbacks on other companies’ oil shipments to retain his business. Detested and illegal (though rarely proven or enforced), drawbacks meant that when a competitor shipped a barrel of oil, part of the money they paid to the railroad was forwarded to Standard Oil. Oilmen from other companies were understandably outraged that their attempts to ship oil subsidized their major competitor.

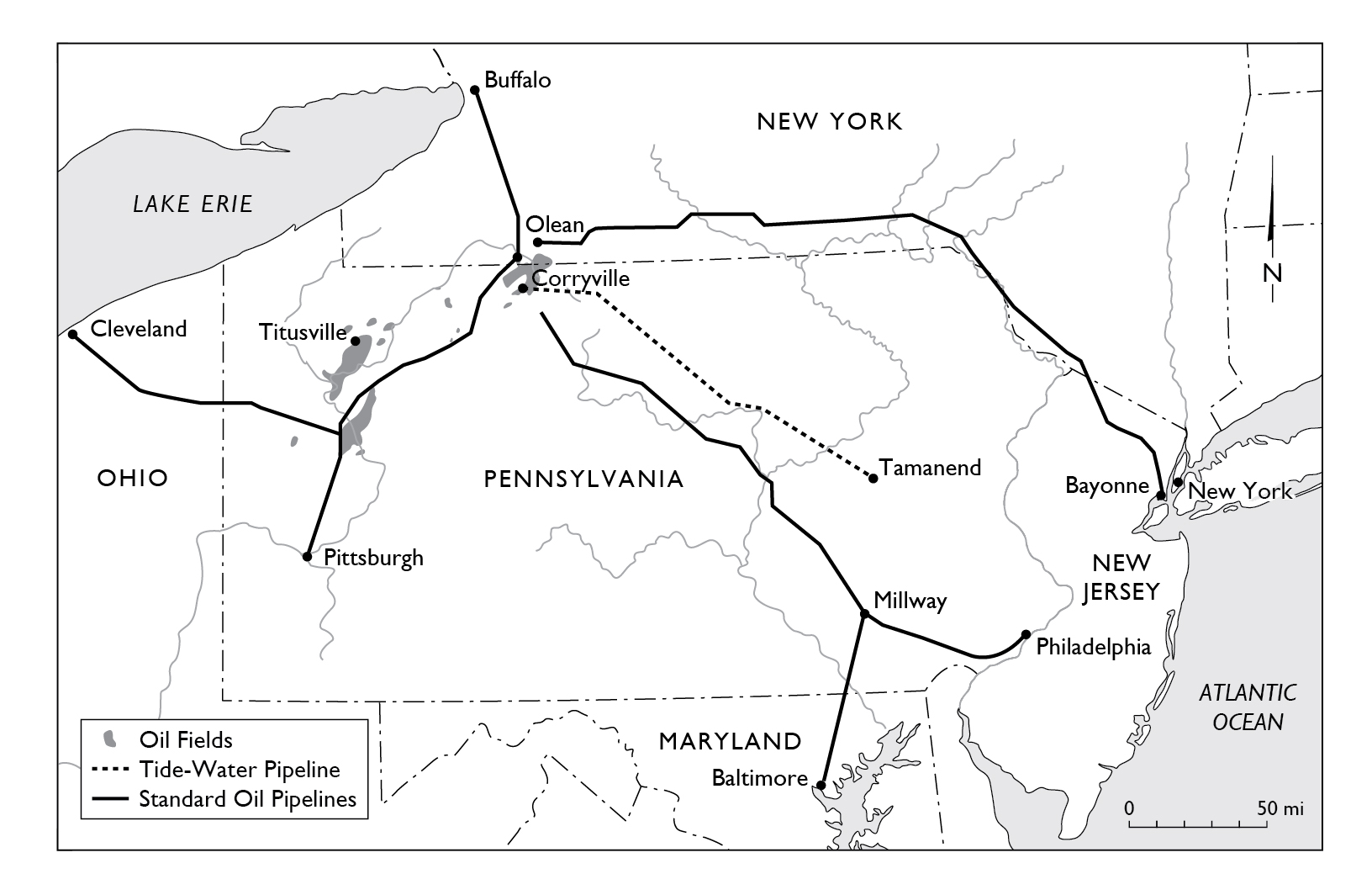

Choked off from fair access to markets, a group of oilmen attempted an audacious undertaking: the construction of the world’s first long-distance pipeline. The Tide-Water pipeline would extend east over a hundred miles, starting in western Pennsylvania and crossing over rugged mountains to the center of the state where it would connect with the Reading Railroad, one of the only major lines not in cahoots with Rockefeller. Tide-Water employees faced numerous technical challenges including developing pumps powerful enough to lift oil without tearing apart the pipes and creating tools capable of connecting 18-foot pipe lengths that weighed more than 300 pounds each. The greater difficulties lay in the underhanded tactics of rough-and-tumble 19th-century capitalism. Both Standard Oil and railroad companies did all they could to stop the pipeline, including ripping up pipes laid under tracks, buying up strips of land to block rights-of-way, and even engaging in industrial espionage: a “bum” that often sat outside the pipeline company’s telegraph office was later discovered to be a Standard Oil employee listening to the click-clack of the telegraph and relaying messages to his supervisors. With a combination of perseverance, engineering acumen, and luck, the pipeline was completed in May 1879 and began shipping oil to markets.

Competitors of Standard Oil hailed the pipeline’s opening as marking a new stage for the industry. Yet their hope that a chokepoint had been alleviated soon turned out to be a pyrrhic fantasy. While the Tide-Water initiated a switch from rail to pipe for oil transport, it did not transform the industry’s competitive dynamics or unlock new flows of oil. Standard Oil quickly appropriated the new technology, built its own pipeline network, and used its strengthened hold of transport to block oil from getting to market. Understanding why this happened illustrates key features of pipelines that help explain why they can serve as chokepoints as well as facilitators.

Once the Tide-Water pipeline proved the viability of the new technology, Standard Oil rapidly built its own network of pipelines. In tackling this project, Rockefeller had unique advantages no other party could match. One was financial—pipelines cost a great deal of money, and Standard Oil had the deepest pockets in the industry. But a more important advantage lay in Rockefeller’s preferential access to rights-of-way. At this time, there were no laws granting eminent domain privileges to pipeline companies seeking rights-of-way, which was in part a product of Standard Oil’s political influence in blocking such legislative proposals. This meant an organization either had to buy an unbroken line of property hundreds of miles in length—which the Tide-Water company only accomplished by building across mountainous stretches of Pennsylvania on land that was poorly suited for agriculture and therefore available—or use someone else’s rights-of-way. In the late 19th century, the railroad companies possessed nearly all the relevant transport corridors. Because Rockefeller had a cozy relationship with them, he was able to negotiate exclusive access to use their rights-of-way in exchange for modest payments and a guarantee of shipments of kerosene from his refineries. With these deals in place, Standard Oil’s pipelines paralleled railroad tracks. No other party had sufficient clout to obtain such rights of way.

For Standard Oil, then, pipelines were an effective means to restrict oil flows. When an independent company built a short pipeline to Buffalo in 1881, Rockefeller ordered a second pipeline built next to it and offered extremely low shipping rates, giving his competitor what he liked to call “a good sweating” (Yergin 1991: 42). The other pipeline company soon went into financial straits and sold out to Standard Oil. Recognizing the dangers of permitting too much oil to reach markets, Rockefeller then had one of the pipelines removed and restored shipping rates to their previous levels. Too much pipeline capacity, Rockefeller knew, undercut profitability. Limiting the capacity of pipelines offered a surer strategy for success.

Tide-Water officials also recognized the value of collaboration to control oil flows. In 1883, they negotiated a settlement with Standard Oil that guaranteed them a set allocation of oil flows in exchange for agreeing not to expand their pipeline. While a New York Times writer bemoaned Tide-Water “fall[ing] under the control of that despotic, unscrupulous, and lawless organization” the company’s founders knew collaborating to curtail oil flows was in their own economic interest (October 17, 1883 article quoted in Jones 2014: 139).

By 1884, more than three-quarters of American oil production flowed to markets in pipelines, and all of it was subject to Rockefeller’s dictates. Having no desire to let too much oil depress market prices, Rockefeller carefully controlled the amount released. As oil producers continued to drill more wells, that extra capacity was put into storage tanks in western Pennsylvania rather than shipping it through pipelines. While in the early 1870s, nearly all oil brought out of the ground was sent to market, the situation changed radically once pipelines were established. During the industry’s first 18 years (up to 1877) a total of about 3 million barrels were put in storage. In the five years oil pipelines were first introduced (1879-1883), the total jumped to 36 million barrels (Derrick’s Handbook 1898). Building enough pipeline capacity to serve their markets—but no more—garnered enormous profits for Standard Oil.

This historical pattern has persisted in the development of pipelines. For industry magnates, the goal has always been to get one’s own oil to market while restricting competing flows. With their high costs and daunting barriers to entry, pipelines have often been an effective tool because they are only profitable if they operate at or near full capacity. In most cases, this means that only a single pipeline along a given route can be economically viable. When there is competition from multiple lines, all operators may take losses until a winner emerges. Pipelines thereby contribute to a centralized and monopolistic structure in the oil industry rather than an open and decentralized one.

Pipelines represent not just the facilitated construction of oil flows from one place to another but also paths not taken. As Rockefeller’s empire suggested, a successful pipeline signifies blueprints abandoned and potential oil flows thwarted. The conventional view of pipelines thus requires a more nuanced perspective. Pipelines are not passive conduits between places; instead, they are always selective in where they deliver oil, whose oil gets preferential access to markets, and how much oil is allowed to reach markets.